退税(增值税申报)¶

拥有注册 :abbr:`增值税`(VAT)号码的公司必须根据其营业额和登记规定,每月或每季度提交 税务申报表 。税务申报表 - 或 VAT 申报表 - 向税务机关提供了公司所做可征税交易的信息。 销项税 是企业销售商品和服务时收取的税款,而 进项税 则是购买商品或服务时添加到价格中的税款。基于这些价值,公司可以计算他们需要支付或退还的纳税金额。

注解

您可以在欧洲委员会的此页面上找到有关增值税及其机制的更多信息: “What is VAT?”.

先决条件¶

报税周期¶

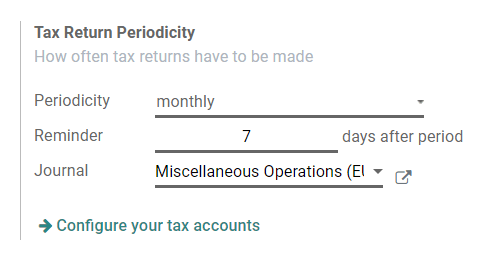

税务申报周期 的配置允许Odoo正确计算您的纳税申报,并向您发送提醒,以确保不会错过任何一个纳税申报截止日期。

为此,请转到 。 在 税务申报周期 下,您可以进行以下设置:

周期性 :在此处定义您是按月还是按季度提交纳税申报;

提醒 :定义Odoo应在何时提醒您提交纳税申报;

日记账 :选择用于记录纳税申报的日记账。

注解

这通常在 应用程序的初始设置 期间进行配置。

税网格¶

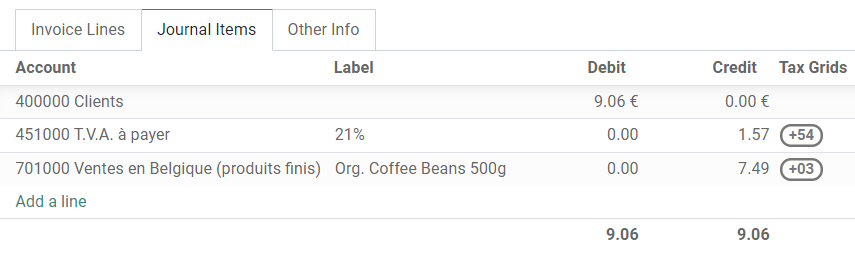

Odoo根据您税收设置中配置的 税网格 生成纳税申报。因此,确保所有记录的交易使用正确的税率非常重要。您可以通过打开任何发票和账单的 日记账分录 选项卡来查看 税率表 。

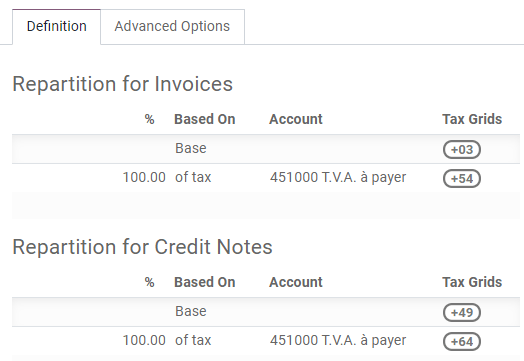

要配置您的税率表,请转到 ,并打开要修改的税项。在那里,您可以编辑您的税务设置以及用于记录发票或贷项通知单的税率表。

注解

Taxes and reports are usually already pre-configured in Odoo: a fiscal localization package is installed according to the country you select at the creation of your database.

关闭纳税期¶

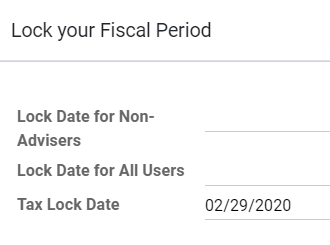

税锁定日期¶

Any new transaction whose accounting date prior to the Tax Lock Date has its tax values moved to the next open tax period. This is useful to make sure that no change can be made to a report once its period is closed.

Therefore, we recommend locking your tax date before working on your Closing Journal Entry. This way, other users cannot modify or add transactions that would have an impact on the Closing Journal Entry, which can help you avoid some tax declaration errors.

To check the current Tax Lock Date, or to edit it, go to .

税报告¶

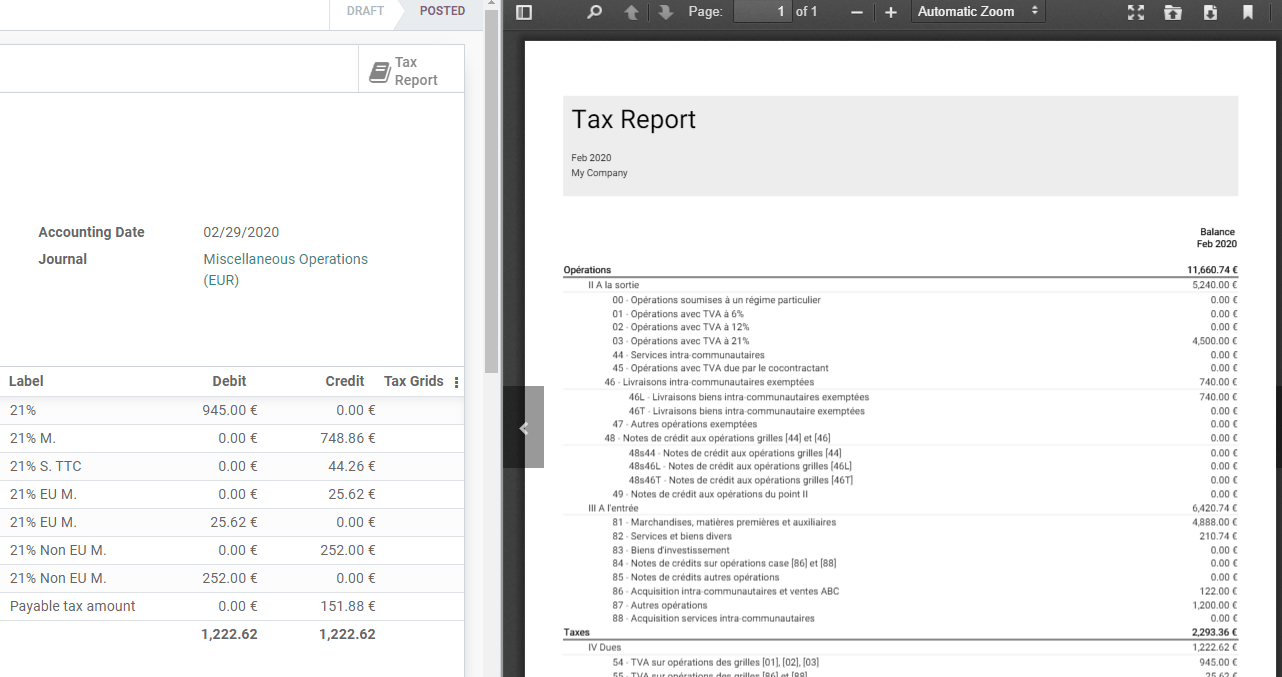

Once all the transactions involving taxes have been posted for the period you want to report, open

your Tax Report by going to . Make sure to select the right period you want to declare by using the

date filter, this way you can have an overview of your tax report. From this view, you can easily

access different formats of your tax report, such as PDF and XLSX. These include all the values to

report to the tax authorities, along with the amount you have to pay or be refunded.

注解

If you forgot to lock your tax date before clicking on Closing Journal Entry, then Odoo automatically locks your fiscal period on the same date as the accounting date of your entry. This safety mechanism can prevent some fiscal errors, but it is advised to lock your tax date manually before, as described above.