欧盟专用报表¶

Intrastat是欧盟成员国之间货物贸易的数据收集和统计生产系统。它收集以下数据:

商业交易记录,包括带有所有权转移的商品用于使用、消费、投资或再销售;

没有所有权转移的货物运输(例如库存调拨或外包生产或加工前后的货物运输以及维修或修理后);

商品退回。

注解

虽然 Intrastat 系统继续使用,但是“Intrastat”一词在 `最新的法规<http://data.europa.eu/eli/reg/2019/2152/2022-01-01>`_ 中不再使用,而改称为“商品内部贸易统计数据”。

参见

“欧统局统计解释-词汇表:内部统计<https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Glossary:Intrastat>’_

General configuration¶

Enable the Intrastat report by going to . Under the Customer Invoices section, tick Intrastat and then Save.

Default transaction codes: invoice and refund¶

You can set a default transaction code for all newly created invoice and refund transactions. Under , select a Default invoice transaction code and/or a Default refund transaction code and then Save. The code will be set automatically on all respective invoice lines.

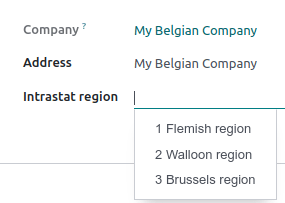

Region code¶

The region code is only used by Belgian companies. Under , select the Company Intrastat Region where the company is located and then Save.

小技巧

If your warehouses are located in more than one region, you can define the region code at the level of each warehouse instead. To do so, go to , select a warehouse, set its Intrastat region, and then Save.

产品配置¶

All products must be properly configured to be included in the Intrastat report.

商品代码¶

Commodity codes are internationally recognized reference numbers used to classify goods depending on their nature. Intrastat uses the Combined Nomenclature.

To add a commodity code, go to and select a product. Under the Accounting tab, set the product’s Commodity Code.

Quantity: weight and supplementary unit¶

Depending on the nature of the goods, it is necessary to specify either the product’s weight in

kilos (without packaging) or the product’s supplementary unit, such as square meter (m2), number

of items (p/st), liter (l), or gram (g).

To add a product’s weight or supplementary unit, go to and select a product. Under the Accounting tab, depending on the commodity code set, either fill in the product Weight or its Supplementary Units.

Country of origin¶

To add the product’s country of origin, go to and select a product. Under the Accounting tab, set the Country of Origin.

Invoices and bills configuration¶

Once products are properly configured, several settings must be configured on the invoices and bills you create.

Transaction code¶

Transaction codes are used to identify a transaction’s nature. Default transaction codes can be set for invoice and refund transactions.

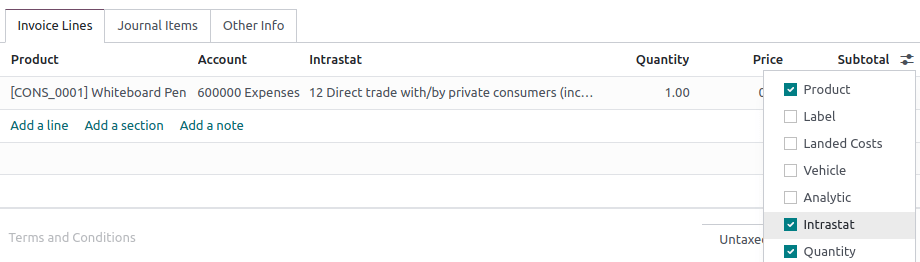

To set a transaction code on an invoice line, create an invoice or a bill, click the columns selection button, tick Intrastat, and use the newly-added Intrastat column to select a transaction code.

Partner country¶

The partner country represents the vendor’s country for bills and the customer’s country for invoices. It is automatically filled in using the country set in the contact’s Country field.

To edit the partner country manually, create an invoice or a bill, click the Other Info tab, and select the Intrastat Country.

Transport code¶

The transport code identifies the presumed mode of transport used to send the goods (arrival or dispatch).

To add the transport code, create an invoice or a bill, go to the Other info tab, and select the Intrastat Transport Mode.

Value of the goods¶

The value of a good is the untaxed Subtotal (Price multiplied by Quantity) of an invoice line.

Partner configuration¶

Two fields from the partner’s contact form are used with Intrastat: VAT and Country. The country can be manually set on the invoice or bill.

Generate the Intrastat report¶

Generate the report by going to . It is automatically computed based on the default configuration and the information found on the products, invoices and bills, and partners.

Export the report as a PDF, XLSX, or XML file to post it to your legal administration.

Each report line refers to a single invoice line and contains the following information:

Invoice or bill reference number;

System, which is a code automatically generated depending on whether the document is an invoice (dispatch) or a bill (arrival);

Country, which is the vendor’s country for arrivals and the customer’s country for dispatches;

(If your company is located in Belgium) Region Code;

Supplementary Units; and

Value, which is always expressed in euros even if the original invoice or bill used another currency.